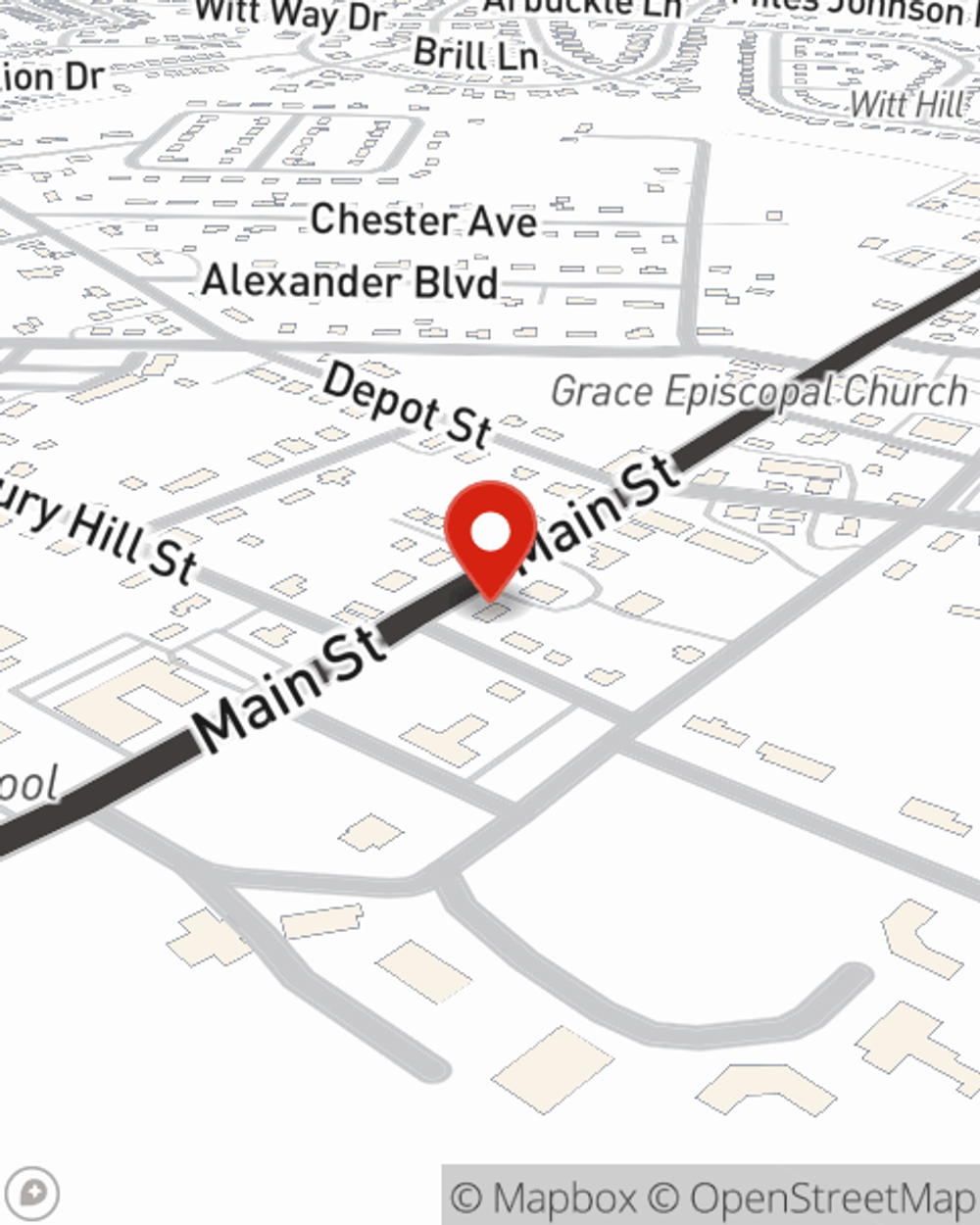

Business Insurance in and around Spring Hill

Looking for coverage for your business? Look no further than State Farm agent Chris Nielsen!

Insure your business, intentionally

- Columbia

- Arrington

- College Grove

- Thompsons Station

- Mt. Pleasant

- Primm Springs

- Williamsport

- Chapel Hill

- Duck River

- Williamson County

- Maury County

- Rutherford County

This Coverage Is Worth It.

Being a business owner isn't easy. You want to make sure your business and everyone connected to it are covered in the event of some unexpected damage or catastrophe. And you also want to care for any staff and customers who become injured on your property.

Looking for coverage for your business? Look no further than State Farm agent Chris Nielsen!

Insure your business, intentionally

Small Business Insurance You Can Count On

With options like extra liability, business continuity plans, a surety or fidelity bond, and more, having quality insurance can help you and your small business be prepared. State Farm agent Chris Nielsen is here to help you personalize your policy and can assist you in submitting a claim when the unexpected does occur.

Don’t let concerns about your business keep you up at night! Reach out to State Farm agent Chris Nielsen today, and find out how you can save with State Farm small business insurance.

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Chris Nielsen

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.